Table of Contents

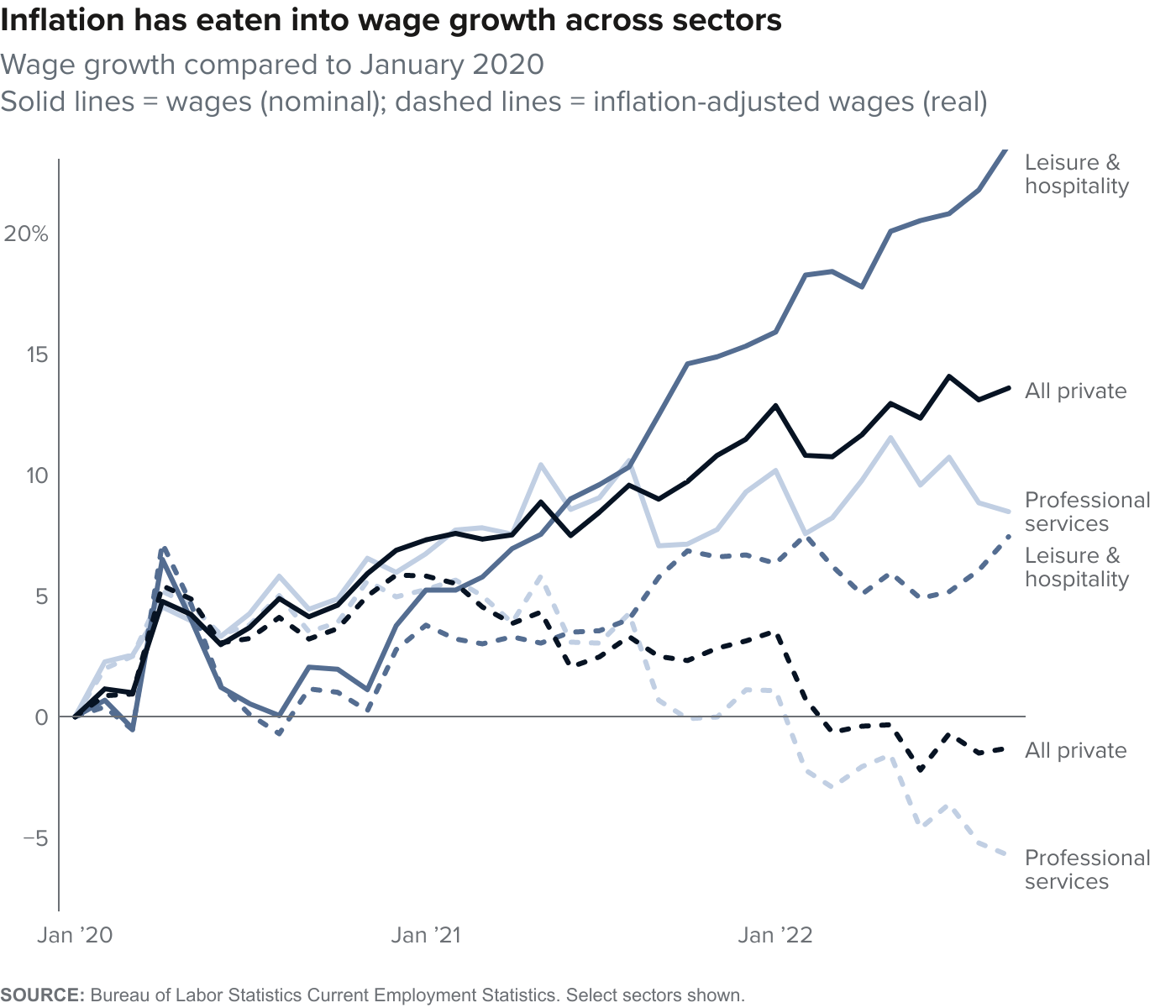

- How inflation concerns could doom California’s Proposition 32 to ...

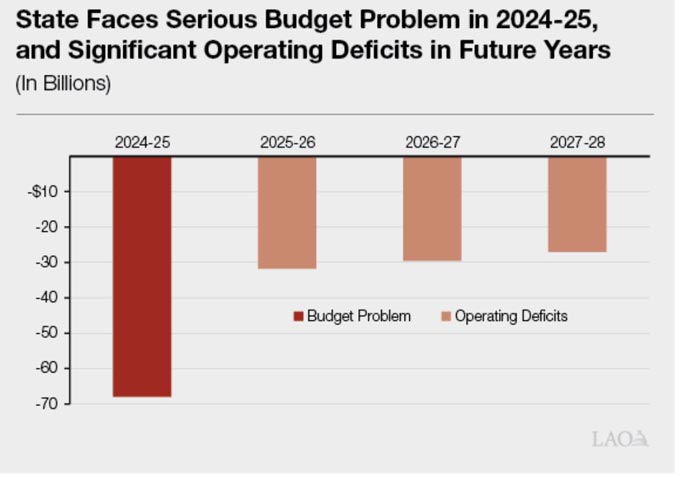

- California Legislative Analyst's Office Reports the State Faces a ...

- Making Sense of California’s Economy - Public Policy Institute of ...

- Making Sense of California’s Economy - Public Policy Institute of ...

- California Inflation Relief Check: when will I receive the payment ...

- Unemployment debt still plagues California budget – Orange County Register

- State of California Economic Forecast

- Inflation rate forecast up to 2025 Source: International Monetary Fund ...

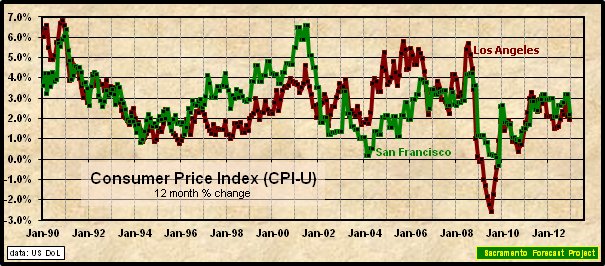

- Southern California inflation heats up in early 2024 – Orange County ...

- Can California’s next governor fix the state’s problems? It depends on ...

Historical Inflation Rates: 2000-2020

The following table highlights the annual inflation rates in the US from 2000 to 2020:

| Year | Inflation Rate |

|---|---|

| 2000 | 3.4% |

| 2001 | 2.8% |

| 2002 | 1.6% |

| 2003 | 2.3% |

| 2004 | 3.3% |

| 2005 | 3.4% |

| 2006 | 3.2% |

| 2007 | 2.9% |

| 2008 | 3.8% |

| 2009 | -0.4% |

| 2010 | 1.6% |

| 2011 | 3.0% |

| 2012 | 2.1% |

| 2013 | 1.5% |

| 2014 | 0.8% |

| 2015 | 0.1% |

| 2016 | 2.1% |

| 2017 | 2.1% |

| 2018 | 2.4% |

| 2019 | 2.3% |

| 2020 | 1.2% |

Projected Inflation Rates: 2021-2025

Using a US inflation calculator can help individuals and businesses make informed decisions about investments, savings, and pricing. By understanding the current and projected inflation rates, you can better navigate the economy and make smart financial choices.

In conclusion, understanding the current US inflation rates from 2000 to 2025 is crucial for making informed financial decisions. By analyzing historical data and projected trends, individuals and businesses can better navigate the economy and make smart choices about investments, savings, and pricing. Whether you're a consumer, investor, or business owner, using a US inflation calculator can help you stay ahead of the curve and achieve your financial goals.Stay up-to-date with the latest inflation trends and forecasts, and use the valuable insights and tools provided in this article to make informed decisions about your financial future.